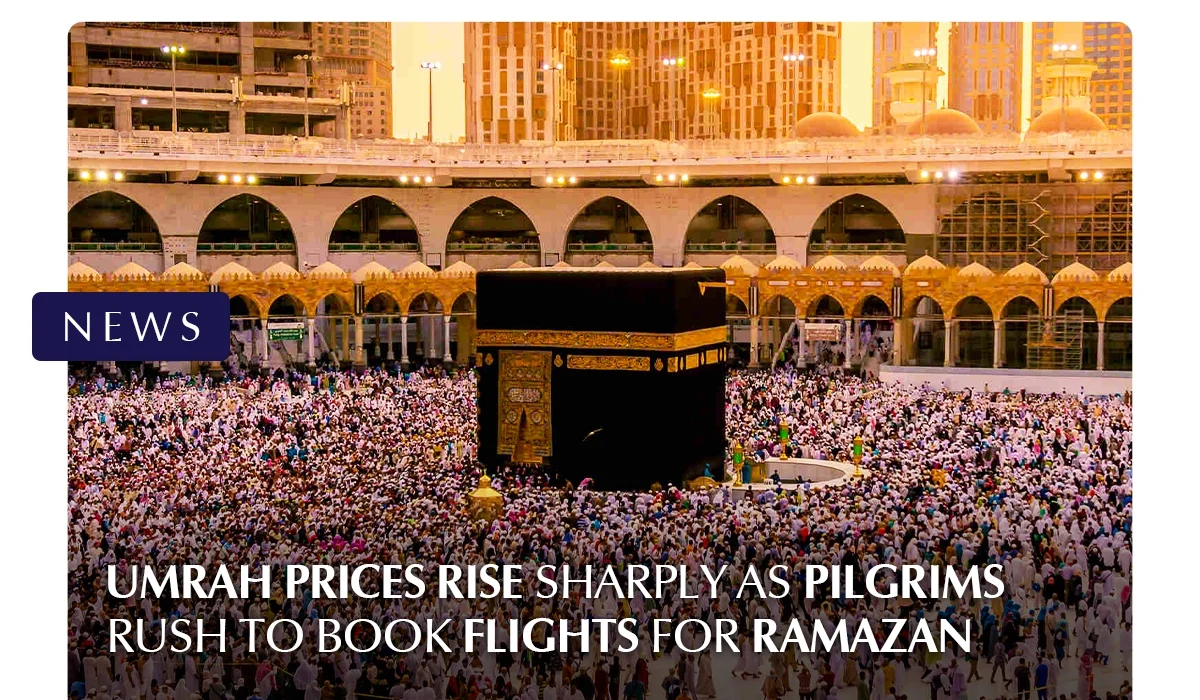

Umrah Prices Rise Sharply as Pilgrims Rush to Book Flights for Ramazan

LAHORE: With the commencement of Ramazan, the holiest month for Muslims, demand for Umrah travel has risen sharply, leading to a significant increase in airfare prices. Umrah, a pilgrimage to Mecca, Saudi Arabia, is a highly anticipated spiritual journey, especially during Ramazan, when many Muslims aim to complete their religious obligations.

The surge in demand has led to a noticeable increase in airline ticket prices, with domestic and international airlines raising fares. Reports indicate that business-class tickets, which were previously priced at around Rs 425,000–Rs 450,000, have now risen to an astonishing Rs 500,000. Similarly, economy and economy-plus tickets, which were available at rates of Rs 130,000–Rs 140,000 earlier, are now being sold at Rs 180,000–Rs 200,000. This price hike has left many pilgrims struggling to accommodate the rising costs in their travel budgets.

Travel agents attribute this surge to the seasonal rush, as many pilgrims prefer to undertake the journey to Mecca during the holy month of Ramazan. The influx of bookings, especially for flights departing in the early and later Ashra, or the ten-day periods, has led to limited seat availability. Consequently, airlines have raised fares to capitalize on the growing demand. Many flights are now fully booked, and only a few seats remain, often at premium prices.

For some pilgrims, this unexpected rise in airfares has made it more difficult to plan their pilgrimage. Families who had previously booked tickets months in advance at lower rates are now finding it difficult to cover the additional financial burden caused by the fare surge.

As the holy month progresses, the situation may become more challenging for individuals and families looking to embark on their spiritual journey, further underscoring the trend of rising airline costs during peak travel seasons.

For more news on the economy, real estate, and development, visit Chakor Ventures.