In a country where economic volatility, rising inflation, and frequent currency fluctuations constantly reshape financial realities, many Pakistanis struggle to find safe yet rewarding ways to grow their savings.

Whether you’re a salaried individual, an entrepreneur, or a non-resident Pakistani sending money back home, the search for the best return on investment in Pakistan has become more critical and more challenging than ever.

With so many investment opportunities in Pakistan available today, ranging from stocks and mutual funds to savings instruments and real estate, the key question remains: Which investment avenue consistently offers strong returns while protecting long-term wealth? And more importantly, why does property so often rise to the top of that list?

In this blog, Chakor Ventures will break down Pakistan’s primary return-on-investment options, compare their risk-reward profiles, and explore why real estate continues to dominate investor preference across the country.

Overview of the Investment Landscape in Pakistan

Pakistan offers a wide range of investment opportunities, each with its own balance of risk, return, and liquidity. Understanding these options helps investors align their choices with their financial goals, whether they seek growth, stability, or passive income.

| Investment Type | Risk Level | Return Potential | Liquidity | Best For |

| Stock Market (PSX) | High | High (but volatile) | High | Investors seeking growth and comfortable with risk |

| Mutual Funds | Medium | Moderate to High | Medium–High | Those wanting diversification and professional management |

| Government Bonds & Savings Schemes | Low | Low to Moderate | Low–Medium | Risk-averse investors seeking stable, predictable returns |

| Commodities (Gold) | Medium | Moderate, long-term stable | High | Investors wanting inflation protection and asset security |

| Savings Accounts & Bank Deposits | Very Low | Low | High | Beginners or those needing quick access to funds |

| Real Estate (Property) | Medium | Moderate to High (long-term) | Low | Investors with long-term goals and sufficient capital |

Real Estate Investing- Best Return On Investment Option in Pakistan

Property continues to outperform many other investment options in Pakistan due to its stability, long-term value, and dual-return structure.

Tangible Asset, Inflation Hedge & Long-Term Value Preservation

Real estate investing offers a sense of security because it is a visible, physical asset that holds intrinsic value. This makes it especially appealing in a market where trust in financial instruments can fluctuate.

Key points:

- Physical & tangible asset

- Investors prefer something real and secure, “something you can see and own.”

- Adds emotional and financial reassurance compared to paper-based investments.

- Natural hedge against inflation

- As inflation rises, property prices and rental yields typically increase.

- Helps preserve purchasing power in Pakistan’s high-inflation environment.

- Strong long-term appreciation

- Urbanisation and rising population pressure keep demand high for housing and commercial units.

- Higher demand in major cities leads to upward price trajectories.

Dual Benefit: Capital Appreciation + Rental Income

Real estate stands out because it delivers two forms of return, making it a comprehensive wealth-building tool.

Key points:

- Capital appreciation over time

- Property values tend to rise as areas develop and infrastructure improves.

- Long-term investors benefit from consistent market growth.

- Steady rental income

- Generates passive income through monthly or annual rentals.

- Offers cash flow even while the property appreciates in value.

- Legacy-building asset

- Ideal for investors with substantial capital seeking long-term security.

- It can be passed down through generations, maintaining wealth stability.

Less Volatile Than Stocks, Lower Risk

Compared to the stock market, which reacts instantly to political and economic changes, property prices move gradually, making it a more predictable investment.

Key points:

- Lower day-to-day volatility

- Real estate values don’t fluctuate dramatically as stock prices do.

- Offers peace of mind for conservative investors.

- Reduced exposure to speculation

- Property markets tend to be steadier and less affected by short-term news cycles.

- Suitable for investors focused on stability rather than fast gains.

- Ideal for long-term horizons

- Works well for individuals who prefer predictable, gradual growth over high-risk trading.

Opportunities in Emerging / High-Demand Areas

Pakistan’s expanding cities and ongoing infrastructure development create promising opportunities for high returns, especially for early investors.

Key points:

- Urban expansion drives demand

- Development of new housing schemes and commercial hubs increases property values.

- New cities and zones offer strong potential for appreciation.

- Infrastructure-led growth

- Roads, transport networks, and commercial activity boost nearby property values.

- Early investment in developing areas often yields above-average gains.

- High returns in commercial real estate

- Shops, offices, and mixed-use spaces generally produce higher rental yields than residential units.

- An attractive choice for investors seeking high annual income.

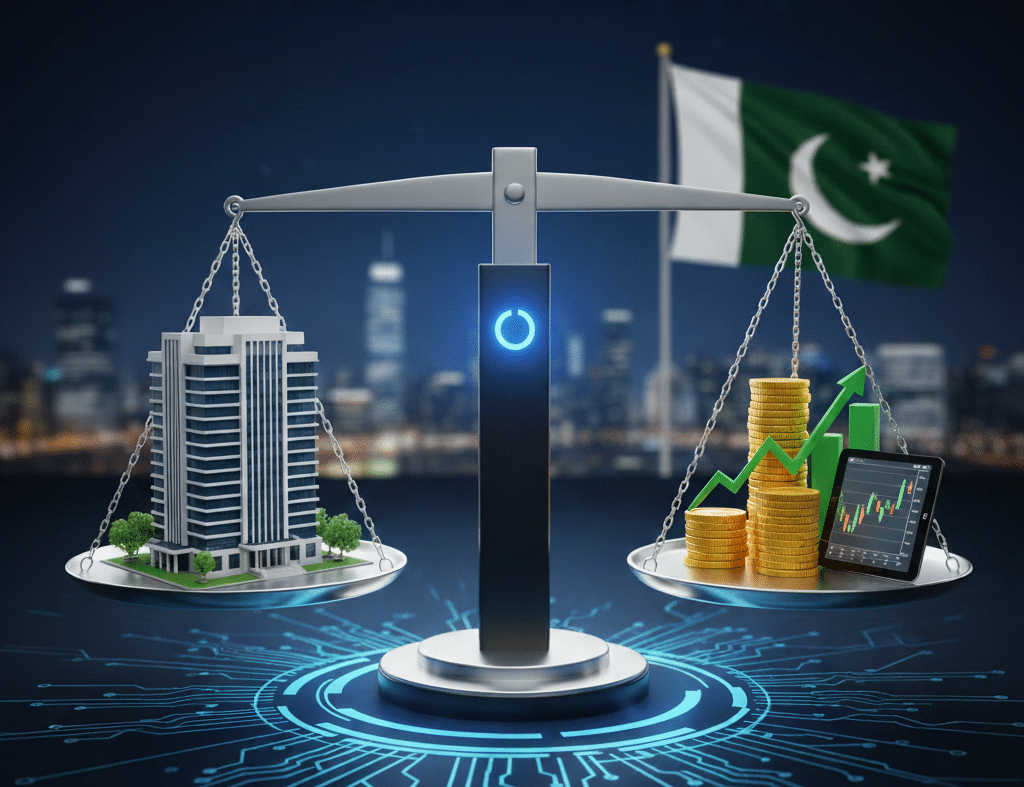

Property vs Other Investment Opportunities in Pakistan

To understand where the best return on investment in Pakistan truly lies, it’s essential to compare major asset classes across key factors: entry cost, liquidity, risk level, expected returns, and the type of investor each option suits.

The table below summarises how real estate stacks up against the most common investment opportunities in Pakistan.

| Investment Type | Entry Cost | Liquidity | Risk | Potential Return / Yield | Ideal For |

| Stocks / Equity (via Pakistan Stock Exchange – PSX) | Low (even small capital) | High — easy to buy/sell | High volatility, sensitive to political/economic events | Historical long-term returns for equities have been high (though fluctuating) | Investors with small capital, seeking liquidity and willing to take risks |

| Mutual Funds / ETFs | Moderate (pooled investment) | Medium–High | Medium risk (diversified) | Moderate returns, balanced risk-reward | Investors wanting diversification without directly picking stocks |

| Government Bonds / Fixed Income / Savings | Low–Medium | Low–Medium | Low risk | Lower but stable returns over medium/long term | Risk-averse investors, capital preservation |

| Real Estate (Property) | High initial capital | Low — illiquid, transaction time is long | Medium risk (documentation, market slowdown, liquidity) | Capital appreciation + rental yield; long-term value & hedge against inflation | Investors with sufficient capital and a long-term horizon, those seeking passive income and asset security |

This was all about the best return on investment options in Pakistan. For more information on relevant topics such as best investment opportunities in Pakistan, and what are the best stocks to invest in Pakistan, visit Chakor Ventures.

FAQs | Best Return on Investment in Pakistan

Which investment is best for high returns in Pakistan?

Among all the best return on investment in Pakistan options, real estate often offers the most stable and high long-term returns.

How to get 10,000 monthly income?

You can achieve this through rental income, high-yield savings certificates, or dividend-paying investments which offer the best return on investment in Pakistan.

What investment is 100% safe?

Government-backed instruments like National Savings Schemes are among the safest options for the best return on investment in Pakistan

What is a 50% return on investment?

It means your investment doubles in value.

Which is the highest return investment?

High-growth real estate and equities often deliver the highest long-term return on investment in Pakistan, though with varying levels of risk.

Is 50% ROI possible?

Yes, but typically, only high-risk investments or rapidly appreciating real estate markets offer the best return on investment in Pakistan.

Is a 30% return on investment good?

Yes, 30% is an excellent return in most markets, including Pakistan.

How to make 30% return?

High-growth stocks or emerging real estate projects may deliver 30% best return on investment in Pakistan under favourable market conditions.

Is 40% return on investment good?

Yes, a 40% ROI is exceptional and is usually associated with high-risk or high-growth opportunities.

Which type of investment gives the highest return?

Equities and real estate historically offer the highest long-term best return on investment in Pakistan.

Is 20% return possible? Best return on investment in Pakistan.

Yes, 20% best return on investment in Pakistan is achievable in strong stock markets or rapidly growing real estate sectors.