A property valuation certificate is an official document that states the fair market value of a property after proper assessment. It is issued by either government authorities such as the Federal Board of Revenue (FBR) or by private firms registered with the State Bank of Pakistan (SBP). The certificate reflects the property’s worth based on its location, size, condition, construction quality, and current market trends.

This document is more than just a piece of paper, it plays a vital role in different financial and legal matters. It is required for taxation purposes, such as calculating capital gains tax and property tax. Banks and financial institutions demand it when approving loans or mortgages against property.

By understanding what a property valuation certificate is and why it matters, property owners and investors in Pakistan can make informed decisions and avoid legal or financial complications.

What Is a Property Valuation Certificate?

A property valuation certificate is an official document that states the fair market value of a property at a specific point in time. It acts as proof of how much a property is worth and is widely used for taxation, loans, legal transactions, and immigration purposes.

Who Issues the Certificate?

The certificate can be issued through two main channels:

- Government Authorities: The Federal Board of Revenue (FBR) or local District Revenue Offices are authorized to issue property valuation certificates. These are commonly required for tax purposes, property registration, or legal documentation.

- Private Valuation Firms: Firms that are registered with the State Bank of Pakistan (SBP) can also issue certificates. These are often used when applying for bank loans, mortgages, or financial evaluations, as banks rely on valuations from SBP-approved firms.

What Is Assessed During Valuation?

When a property is being evaluated for its certificate, surveyors and experts take into account a wide range of factors to calculate its value:

- Location – where the property is situated, including city, neighborhood, and proximity to main roads or commercial hubs.

- Structure and Materials – quality of construction, type of materials used, and overall condition of the building.

- Soil and Land Quality – especially important for plots or agricultural land, where soil strength and land usability affect value.

- Utilities and Amenities – access to water, gas, electricity, sewerage, and nearby facilities like schools, hospitals, and markets.

- Market Comparables – prices of similar properties in the same area.

- Interior & Exterior Quality – design, finishing, layout, and overall aesthetic appeal of the property.

In short, a property valuation certificate is a reliable document that reflects the true market worth of your property by considering all physical and market-based factors.

Who Issues the Property Valuation Certificate?

In Pakistan, property valuation certificates can be obtained through two main paths:

1. Government Path

The Federal Board of Revenue (FBR) and local Excise & Taxation offices are authorized to issue valuation certificates. In this process, an official surveyor visits the property, inspects it on-site, and evaluates its worth based on government valuation tables and prevailing market trends. Certificates issued by these authorities carry strong legal weight and are commonly used for:

- Taxation purposes, such as calculating capital gains or property tax.

- Property transfers and registration with government offices.

- Legal disputes, where official proof of value is required in court.

2. Private Path

Alongside government bodies, private valuation firms registered with the State Bank of Pakistan (SBP) are also allowed to issue property valuation certificates. These firms follow professional valuation methods and provide detailed reports, often faster than government channels. Their certificates are especially useful for:

- Bank loans and mortgages, as financial institutions rely on SBP-approved valuations before approving financing.

- Investor needs, where quick and independent valuations are required for decision-making.

- Property transactions, where buyers and sellers want a reliable, neutral estimate of value.

Both government and private paths serve important but slightly different purposes. While government-issued certificates are mandatory for legal and tax compliance, private firm certificates are preferred in financial and commercial matters like securing loans or finalizing investments.

Step-by-Step — How to Get Your Certificate

Getting a property valuation certificate in Pakistan is a straightforward process if you follow the right steps. Here’s how it works:

1. Gather Required Documents

Start by collecting all the necessary paperwork. Commonly required documents include:

- Copy of your CNIC

- Title deed or allotment letter of the property

- Registry/Fard to confirm ownership

- Recent utility bills (electricity, gas, water)

- Any previous valuation reports (if available)

Having these documents ready helps avoid delays during the application process.

2. Submit Application

Once the documents are in order, submit your application through the proper channel. This can be done by:

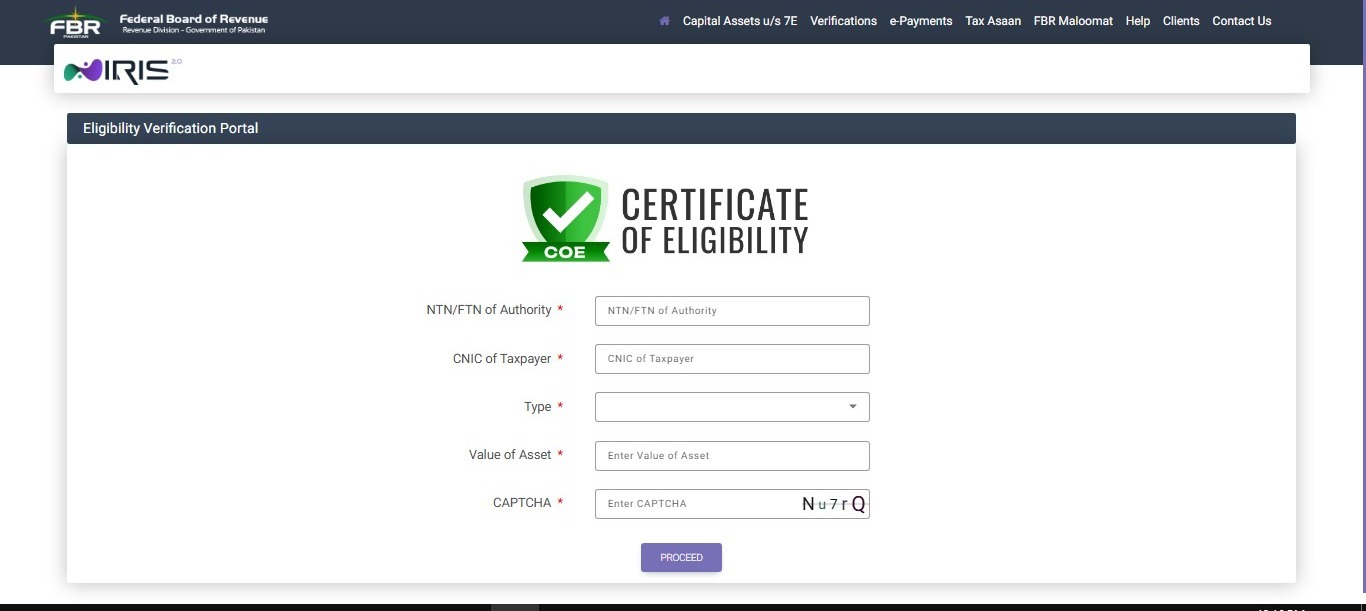

- Visiting the FBR portal or the local revenue/excise office for a government-issued certificate.

- Contacting an SBP-registered private firm if you are seeking a certificate for bank loans or faster service.

3. Property Inspection

After the application is filed, a surveyor or valuation officer will visit your property. During the inspection, they assess:

- Location and accessibility

- Size and layout of the land or building

- Quality of construction and building materials

- Nearby amenities and utilities

- Comparison with similar properties in the area

This inspection is the foundation for determining the accurate market value.

4. Receiving the Certificate

Once the evaluation is complete, the certificate is prepared and issued. In most cases, this process takes about 5 to 10 working days, though timelines may vary depending on the authority or firm you apply through.

5. Fee Payment

The cost of getting a property valuation certificate depends on the issuing body:

- Government-issued certificates usually come at a lower fee.

- Private firm certificates may cost more but are often faster and include detailed reports accepted by banks.

By completing these steps, you can obtain an official property valuation certificate that reflects the true market value of your asset and can be used for taxation, loans, legal, or personal purposes.

DC Value, FBR Value, and Valuation Methods

Property valuation in Pakistan can be a bit confusing because different authorities use different values. To understand the process better, it’s important to know the difference between DC value, FBR value, and market value, along with the common methods used to calculate property worth.

DC Value (District Collector Rate)

The DC value is the rate set by the local District Collector for property transactions. It is mainly used to calculate:

- Stamp duty

- Capital Value Tax (CVT)

This value is often lower than the market rate and is used by provincial authorities when registering or transferring property.

FBR Value

The FBR value is determined by the Federal Board of Revenue and is applied nationwide. It plays a key role in calculating federal taxes such as capital gains tax and withholding tax on property transactions. Like DC values, FBR rates are also usually below the actual market price.

Market Value

The market value reflects the actual price a buyer is willing to pay and a seller is willing to accept for a property in open market conditions. It is usually higher than both DC and FBR values, which creates a gap between recorded values and real transaction prices.

FBR Value vs DC Value vs Market Rates

- DC Value: Used at the provincial level for stamp duty and CVT.

FBR Value: Used at the federal level for taxation purposes. - Market Value: The real price based on demand, location, and market conditions.

This difference often leads to discrepancies in property taxation and can create confusion for buyers and sellers.

Five Common Valuation Methods

Property experts and surveyors generally use one or more of the following methods to determine accurate value:

- Comparison Method – Compares the property with similar ones recently sold in the area.

- Investment Method – Calculates value based on the expected return or rental income.

- Residual Method – Common for development projects; value is based on potential profits after construction or redevelopment.

- Profits Method – Often used for commercial properties like hotels or shops, where income generation determines value.

- Cost Method – Considers the cost of building the property today minus depreciation, plus land value.

These methods provide a more realistic and detailed assessment of property value compared to the fixed DC or FBR tables.

Policy Context & Challenges

The property valuation system in Pakistan has long faced issues of inconsistency and lack of transparency. While steps have been taken to improve the process, several challenges still remain.

Lack of Standardization

One of the biggest challenges is the absence of a uniform valuation system across the country. Different authorities apply different values—DC rates, FBR values, and market rates—which creates confusion for buyers, sellers, and investors. This lack of standardization often results in undervalued transactions being recorded officially.

Updates by FBR

Since 2016, the Federal Board of Revenue has updated its valuation tables for multiple cities. These revisions aimed to bring official values closer to market prices and increase tax revenue. However, even after updates, FBR values still remain lower than actual market rates. This gap exists partly to encourage compliance and partly to reduce pressure on taxpayers, but it continues to distort the real estate market.

Encouragement of Black Money

Because of the difference between official values and true market rates, many property transactions are recorded at artificially low figures. The remaining amount is often exchanged in cash or “grey money.” This practice allows tax evasion, reduces government revenue, and makes it difficult to track the true flow of money in the real estate sector.

Market Distortion

These weaknesses in the system affect fair property pricing. Buyers and sellers may face mistrust in transactions, investors struggle with unclear valuations, and the government loses significant tax income. Without a standardized, transparent system, the property market remains vulnerable to manipulation.

Other Related Property Processes & Legal Terms

Property valuation is closely tied to other legal processes in Pakistan’s real estate sector. Understanding these related terms and documents is important for smooth transactions.

Property Registration vs Valuation

- Valuation determines the market worth of a property. It helps in tax assessment, loan approval, and ensuring a fair deal between buyers and sellers.

- Property registration, on the other hand, is the legal process of recording the property under the buyer’s name in government records. This is done through local registrars or revenue offices. Without proper registration, even a valued property has no legal standing in ownership disputes.

Together, valuation and registration ensure that a property is both fairly priced and legally protected.

Key Documents in Property Ownership

- Fard – An official record of ownership, issued by the revenue department.

- Inteqaal – The process of transferring ownership from one person to another.

- Jamabandi – A land record that shows details of ownership, cultivation, and revenue collected.

- Gardavri – A seasonal record of crops and land use, important for agricultural properties.

- Haq-e-Shufa – The “right of pre-emption,” allowing certain relatives or neighbors to claim first right if a property is being sold.

Knowing these terms helps property buyers and sellers navigate legal requirements and avoid disputes.

FAQs

Here are answers to some of the most common questions about property valuation certificates in Pakistan:

How long does it take?

Usually between 5 to 10 working days, depending on whether it’s processed by a government office or a private firm.

Can I get a free valuation?

No. Property valuation always involves a fee, as surveyors and agents must be paid for their professional assessment.

Which option is better: government or private certificate?

Government-issued certificates carry more legal and tax-related weight, making them necessary for official transactions.

Private certificates are generally faster and are preferred when applying for loans or mortgages.

What if I disagree with the valuation?

You can request a revaluation or file an appeal through the concerned authority or valuation firm. In many cases, presenting updated market data can support your case.

Conclusion

A property valuation certificate is more than just a formality—it is a key document for ensuring transparency, fairness, and legal compliance in Pakistan’s real estate market. From paying taxes to securing bank loans and even applying for visas, this certificate proves the true market value of your property and helps prevent disputes.

Both government-issued and private certificates serve important roles. Government certificates are essential for legal and tax matters, while private certificates provide speed and flexibility, especially in financial dealings. Choosing the right path depends on your specific needs.

For more information on relevant blogs like navigating NADRA centre in Islamabad, visit Chakor blogs!