As per official sources, the process of filing annual income tax returns and asset statements of real estate investments for the tax year 2023 has begun. Starting from July 1, the FBR has activated its return filing portal, IRIS; the last date for the submission is set for September 30, 2023.

Fortunately, the online system ensures a safer process compared to the conventional method, which often led to mishandling or losing before reaching the system. The availability of e-filing added the advantage of convenient re-access and prompt execution of desired actions.

Whether you are a first-time or a seasoned filer… this quick guide will help you through the process and ensure effective payment of tax obligations.

Online Income Tax Filling in Pakistan 2023

A tax return is a set of forms submitted to a tax authority, detailing income, expenditures, and other tax-related data. With this, you can compute your tax obligation, schedule tax payments, and/or apply for tax refunds.

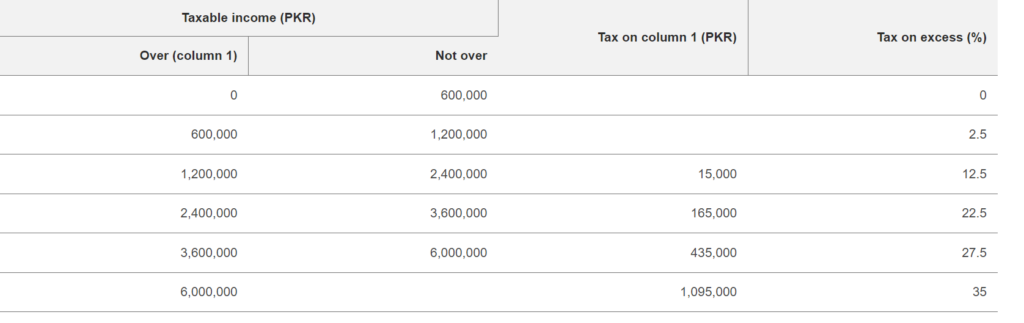

Before proceeding, let’s quickly go through the income slabs that are applicable for tax filing;

Courtesy; Pwc

Guide to File Income Tax Return Online in Pakistan

However, the tax payment process has challenges, complexities, and overwhelming procedures, especially for those new to the system. To aid you, we have simplified the explanation into a step-by-step process.

Step #1 Gather Required Documents

Before we start the journey of filing for the online tax returns payment, initially, we need to collect all the essential documents required.

This includes the NTN (National Tax Number), the computerized CNIC, bank statements, investment records, salary certificates, and other relevant financial documents. The presentation of documents will streamline the process and assure the accuracy of the information.

Step #2 Register on the FBR Portal

Pakistan’s Federal Board of Revenue (FBR) has embraced the technology to facilitate taxpayers in the country. Initially, in the process, you need to create an account on the FBR portal (iris.fbr.gov.pk).

Yes, remember if you are not registered already, then need your NTN and CNIC details to create the account. This process needs to be attempted with care and vigilance if the information would be inaccurate or not up-to-date, the process might be withdrawn or stopped.

Step #3 Choose the Appropriate Form

You would find some tailored income tax forms to different income sources by FBR. Hence, the issue arises that you must select the correct form that aligns with your income stream.

Otherwise, there would be a misrepresentation, and you might file for a wrong tax payment. It will be a hassle to get it refiled and corrected. For example, Income Tax for salaried Individuals Forms IT-1 and Form IT-3 for a business individual.

Step #4 Fill the Form

After the correct/appropriate form is selected, it will be completed. Accuracy is a crucial step. You need to fill in with valid and authentic information. It would help if you assured me which bracket is applicable to you. So, do opt for the appropriate tax rate for your income level.

Remember that the accuracy of the information you provide is essential for a smooth and transparent filing process.

Step #5 Calculate Tax Liability

The next step to go ahead with is calculating your tax liability. You will find different tax rates for various income brackets, so ensure you know the correct tax rate for your income level. Consider the deductions, rebates, exemptions, or tax credits you are eligible for.

It will help you reach an accurate figure for your tax liability.

Step #6 Submit the Form Online

The heart of the process is the online submission of the tax return form. You must log into the FBR portal account and upload the completed tax return form. Ensure the attached documents like bank statements, salary certificates, and supporting documents are properly attached.

This step creates an electronic record of your tax return submission.

Step #7 Verify and Submit

Before you click the submit button, you need to study and thoroughly go through the entire form. Review all information entered in the form. Once verification is done, the correct data is input, so proceed with the electronic form submission.

Once submitted, you will receive an acknowledgment receipt confirming the successful submission of the tax return filed.

Step #8 Pay Outstanding Tax, if any

If the tax calculation shows that you owe additional tax, clearing this outstanding amount is essential. You can efficiently utilize online banking channels, such as Internet banking or mobile banking, to pay off your remaining tax figure.

You can also use the Electronic Challan Form(e-challan). You must ensure payment is made before the due date to avoid penalties or legal consequences.

Step #9 Save the Records

Be comprehensive while maintaining the record of relevant documents while completing the filing process. You need to print out a copy of the submitted tax return form to keep it as a record. These documents are valuable for references and future compliance and audit purposes.

Tips to File Income Tax Returns Online

- Timely Filing: Filing your income tax returns by the due date is critical. Late filing can lead to penalties and legal consequences.

- Seek Professional Help: If you need clarification on any aspect of the process, consider seeking guidance from tax professionals or consulting the FBR helpline.

- Confidentiality: Ensure your personal and financial information is kept confidential and secure during the filing process.

- Yearly Commitment: Remember that filing income tax returns is an annual obligation. Each financial year brings a new filing cycle.

Conclusion

In Pakistan, you have some essential responsibilities to fill out. One of them is filing income tax returns. We have provided you with the vital information in our guide. You can easily navigate the process and ensure compliance with tax laws.

Once you accurately report your deductions, income, and tax liability, you contribute to the country’s economic progress while safeguarding your financial interests. Embrace your role by being informed and staying compliant.

Now, in Pakistan, the Online tax payment procedure is more convenient and efficient through technology. So look forward to our guide and get maximum help.