Recessions are unpredictable, they often take place before one can get to know; businesses with no or limited contingency planning, even big organizations, face losses during an economic slump. Talking about Pakistan, only stable sectors like real estate, agriculture, IT, etc., manage to survive challenging times.

A bad economic situation is no less than a tornado – it emerges from nowhere, and companies tend to collapse.

Yet, the recession could not be predicted or controlled quickly once it strikes, but some measures could be taken to make the businesses recession-proof. There are some ways/plan Bs, which can be practiced by entrepreneurs through the challenging times.

Recession-proofing your business is essential for long-term success, as economic downturns can happen unexpectedly and significantly impact your revenue.

Let’s get saving… our businesses from the rough times!

Strategies to Recession-proof your Business

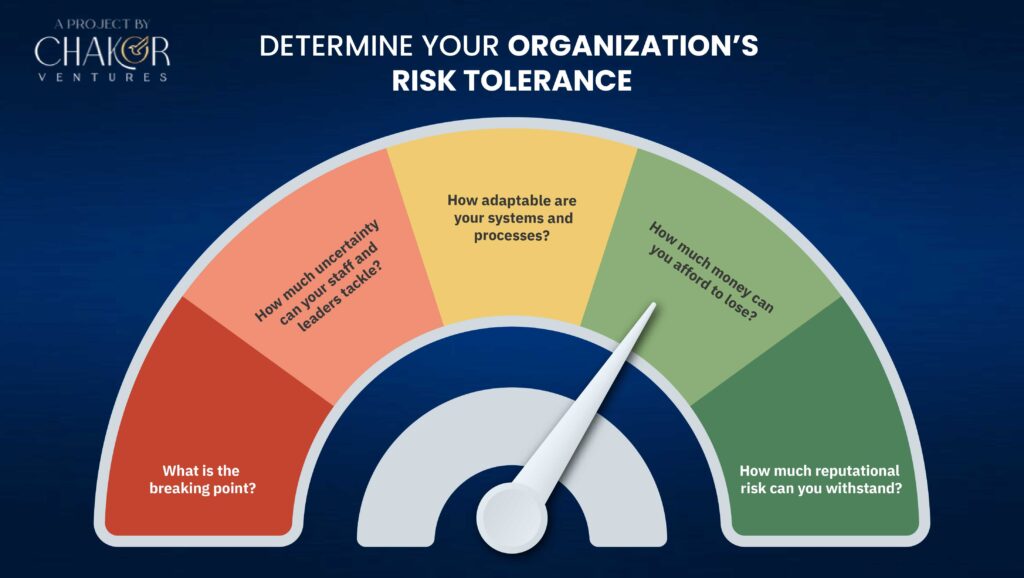

Before jumping into strategies/tips to keep the investments recession-proof, enterprises need to evaluate their risk tolerance.

Short of business risk tolerance, it’s a company’s willingness to take on risk in pursuit of its objectives. It is the degree to which a company is willing to tolerate the possibility of negative outcomes, such as financial losses, in times like economic crunch.

A company with a high risk tolerance get through the difficult times by investing in new technologies or markets, pursuing aggressive marketing or pricing strategies, or taking on high levels of debt to finance growth.

Conversely, a company with a low risk tolerance prefer stability and business activities that are less likely to result in financial losses. This might involve prioritizing cost control, high levels of cash reserves, or avoiding risky decisions.

To extend the risk-averseness, it is important for companies to regularly assess their risk threshold and adjust their strategies and activities accordingly, especially in challenging times such as a recession.

Tips/Tricks to recession-proof your business

These are valid tips/strategies that can help businesses, especially the ones run by young entrepreneurs to reduce the recessionary impacts and extend their survival in the long run.

#1 Cash Flow Management

In a recession, cash flow is affected badly, as cash exchanges get restricted, so to avoid liquidation during a recession, businesses need to carefully monitor their daily costs and expenses, and manage cash reserves.

For good companies, having a financial backup helps stay/survive in the market; working capital needs to be flexible enough to adjust sudden cash requirements. One approach to survive bad times is to have an emergency fund – to cover everyday cash requirements.

#2 Support your Workforce

The lifeblood of an organization is their workforce, and unfortunately, they faced the most in a testing times, like recession; in an economic downturn, employees get redundant due to business failures and unemployment increases.

To back your teams in times like economic slump, it’s entrepreneurs responsibility to support them, both financially and morally. One of the best ways to cross-train them, giving them platforms to polish their skills and expand their career potential.

#3 Business Budget Controls

Controlling business budget during a recession can be challenging, but there are some strategies, like…

- Reviewing the budget (reduce employee hours/salaries, renegotiate with suppliers, find cheaper alternatives for materials, or else)

- Prioritize essential expenses (payroll, rent, and utilities) and cut back on non-essential expenses; create a cash flow forecast and track your expenses

- Consider alternative funding sources (loans, grants, or crowdfunding)

- Regularly monitor your progress and make changes quickly to stay ahead of any potential financial issues.

Recession never informs, but well-planned budgets will help companies survival.

#4 Beat the Competition

During a recession, businesses need to focus on their core strengths, which means keep themselves different from competitors and provide value to customers.

Other ways to remain top-of-the-mind are;

- Companies can cut costs without sacrificing quality

- Start offering promotions and discounts, and remain innovative and adaptive.

- Finding new ways to synch with the changing market conditions, like introducing new products, exploring new markets, or adopting new technologies.

Customer relationships and business collaborations are also key factors in securing competitive edge, sharing resources, reducing costs, and improving efficiency especially during tough times.

#5 Marketing

During a recession, marketing practices can be challenging because consumers often have less disposable income and are more cautious about spending. However, with the right strategies, companies can continue to promote their brand and products effectively.

Some good practices include, working on the core audience only, offering discounts and promotions, emphasizing on the value of the product, developing creative/outside the box campaigns, going digital (using social media, email marketing, and other digital channels), and keep monitoring the metrics (sales, customer retention rates, and others).

#6 Crises Management

To deal with any sort of crises, businesses need to develop a crisis management plan, so for the economic recessions too.

One of the best crises management practice is to keep all the stakeholders (employees, customers, suppliers, and investors) updated regularly. This helps businesses to remain transparent and maintain strong relationships with them, seeking their input in low situations encourage everyone to work together and find solutions to challenges.

To develop a recession-proof crises management plan, companies can seek professional help from financial advisors, crisis management consultants, or legal counsels.

Saving Businesses

Recessions are scary and takes time to reverse. When the industry realizes the adversity of recession has hit them.

Hence, they need to be planned strategically and forecast the future with these useful tips!